Unicorns Ruled for a Decade. Tech Needs a New BeastUnicorns Ruled for a Decade. Tech Needs a New Beast

The era of obsessing over lofty valuations needs to end. It's time to refocus on revenue.

June 10, 2024

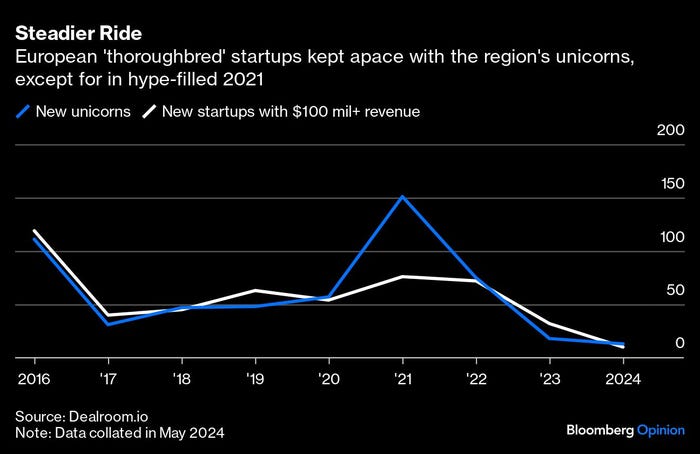

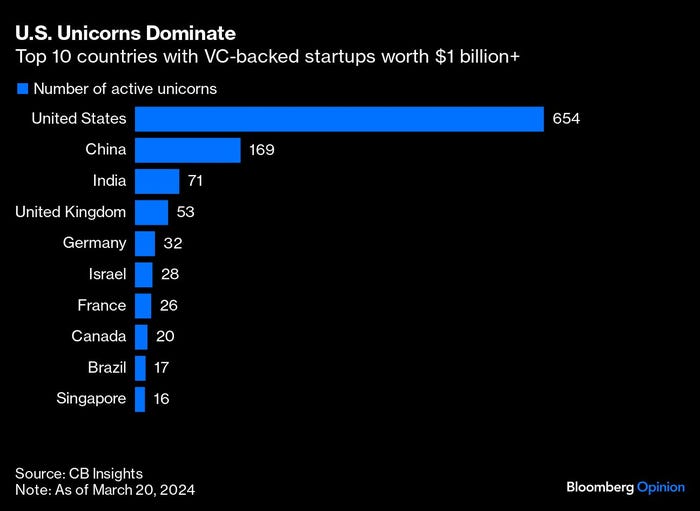

(Bloomberg Opinion/Parmy Olson) — It's been a decade since the term "unicorn" was coined by Silicon Valley venture capitalist Aileen Lee to describe startups that reached a $1 billion valuation. The name quickly became coveted. Yet today, unicorns aren't so rare. Having reached a peak in the heady, liquid days of 2021, the number of startup unicorns being created globally is now in decline, to 95 last year from 621 in 2021, according to market intelligence firm CB Insights, thanks in part to higher interest rates and greater scrutiny from investors.

In some ways, that has been a healthy correction. As the rise of generative AI threatens to create more froth in the market once again, though, investors should maintain their focus on startups that have strong fundamentals as well as long-term promise. Here's a new name for firms that fit the bill: thoroughbreds.

These are companies bringing in at least $100 million in revenue annually, according to Saul Klein, founder of London venture capital firm LocalGlobe, who is pushing for a change in the investing lexicon. Startups that have at least $25 million in annual turnover are "colts," he adds.

He isn't the first to try and steer the conversation back toward more rational investing with a creature-related metaphor. Others have proposed dragons or centaurs, though Klein wants to avoid mythical beasts. "It's not just about hope and promise, but hope and promise times fundamentals," he says. The last few decades have shown that new tech can reshape industries and boast exponential growth, hence why venture capital has become one of the best-performing asset classes over the past decade, according to Morgan Stanley.

But the "unicorn" label has spun out of control, with startups sometimes resorting to desperate measures to achieve its coveted status as quickly as possible. Some would engage in multiple fundraising rounds over short periods to hit the magical $1 billion threshold, while others pivoted to trends like blockchain or AI to capitalize on market hype. WeWork famously touted unrealistic growth targets as its valuation soared past "decacorn."

Europe is a good place to shift the focus to revenue thanks to its transparency requirements. The region's startups still lag Silicon Valley in their ability to acquire higher, later-stage funding, making it harder to scale up to become the next Microsoft Corp. or Alphabet Inc. But local VC firms already prioritize sustainable business models over valuation metrics, in part because they can see the numbers. Unlike their US counterparts, European startups are subject to more stringent regulations requiring financial disclosures.

Although it's almost impossible to find out revenue figures for US companies like San Francisco-based Scale.ai (which just raised $1 billion at a $14 billion valuation) or its neighbor Anthropic (which is said to be worth between $15 billion and $20 billion), you can easily get them for any two-person private firm in the UK, since all registered businesses must file annual financial statements with Companies House, the government's registrar.

Until now, European institutional investors have taken that approach too far, shying away from putting their money into new tech that held great promise. When the AI lab DeepMind was getting off the ground, its founders struggled to find backers who would put more than £30,000 ($38,000) into the enterprise and had to fly to Silicon Valley to get the millions they needed from the likes of Peter Thiel and Elon Musk instead. (Eventually, Google bought DeepMind for $650 million.)

It didn't help that European investors were cajoled into doing their patriotic duty by "supporting" the local tech ecosystems — think French President Emmanuel Macron targeting 25 unicorns by 2025. "Investors were reasonably saying, 'For what?'" says Klein. "These science projects? This is people's retirement savings. We're not charities." To turn the tide, it might help for institutional investors to see the broad number of thoroughbreds across the country and the wider European region.

British investors, for one, are poised to make bigger bets now that its domestic pension providers — who manage assets worth about $3 trillion — have pledged to assign 5% of their default funds to "unlisted equities" by 2030, providing a boost to the country's tech sector. They would do well to turn their attention to the 118 startups in the UK that are bringing in more than $100 million in revenue, according to market intelligence firm Dealroom.io.

Startups themselves should also resist unicorn envy. In the long run, success can become as mythical as the name.

About the Author

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)