The Impact and Future of AI in Financial ServicesThe Impact and Future of AI in Financial Services

An early adopter of AI, the finance sector is using the technology in new ways while keeping an eye on ethical use and governmental regulations.

In the 1980s, mathematician Jim Simons founded Renaissance Technologies, a hedge fund that uses statistical pattern recognition – a form of artificial intelligence – to predict investment returns. The company’s Medallion Fund is renowned for achieving nearly a 40% net average annual return through 2018.

As the Medallion Fund demonstrates, the use of AI in financial services is not new. The vast amount of data in the sector has always made it ideal for AI innovation, noted Dr. Sherry Marcus, director of generative AI science at Amazon Web Services (AWS). Indeed, insurance companies have been using machine learning to detect fraudulent claims for a decade, and lenders have employed predictive models for loan default analysis.

“The evolution of AI in financial services has been driven by several factors, including the availability of large datasets, increased computing power, and the development of more advanced algorithms,” said Dr. Eric Ludwig, director of the Retirement Income Certified Professional program at the American College of Financial Services. “As AI continues to evolve, it has the potential to transform the industry even further, enabling financial institutions to provide more personalized and efficient services to their customers.”

Until recently, AI was primarily the domain of skilled data scientists. However, the advent of generative AI is now democratizing access to the technology, according to Richard Winston, a global industry lead for financial services at consulting firm Slalom. This trend, known as “citizen AI,” allows a broader range of users to leverage AI tools.

Key Applications and Examples

Over the years, various applications, including fraud detection, portfolio optimization, and enhanced customer service, have used AI.

Consider the following examples:

MasterCard’s Decision Intelligence uses historical purchasing and spending patterns to establish a baseline for each customer rather than applying a generic template. New transactions are measured against the baseline to detect anomalies for further investigation.

Sentient Technologies, a U.S.-based AI startup, operated a trading hedge fund that processed millions of data points and transactions to forecast trends. By simulating millions of trading scenarios, it adopted optimal trading strategies.

The bank ING developed Katana, an internal tool for making bond trades. Katana scanned the bond market and used machine learning to detect anomalies. ING later spun off Katana as a fintech company, Katana Labs, with additional investors.

Bank of America’s AI chatbot, Erica, analyzes transactions to help users manage their finances.

In 2003, the U.S. Securities and Exchange Commission (SEC) disclosed its use of a natural-language processing model to detect accounting fraud. Currently, the SEC employs the Corporate Issuer Risk Assessment program, which scans corporate filings and generates a list of 230 metrics to help staff identify potential fraud and misconduct risks.

Mixing generative AI and ML expands the range of applications in the financial sector. Winston shared four use cases:

Financial institutions can use generative AI to simulate extreme market conditions and then apply ML to assess the resilience of their strategies and operations under these scenarios.

Generative AI can create synthetic fraud scenarios to train ML models, enhancing their ability to detect novel types of fraud.

Generative AI can develop personalized investment strategies tailored to individual risk profiles and financial goals, which ML models can then optimize using market data and historical performance.

Generative AI can produce comprehensive financial reports based on data insights from ML models, including earnings reports, market analysis, and investment recommendations.

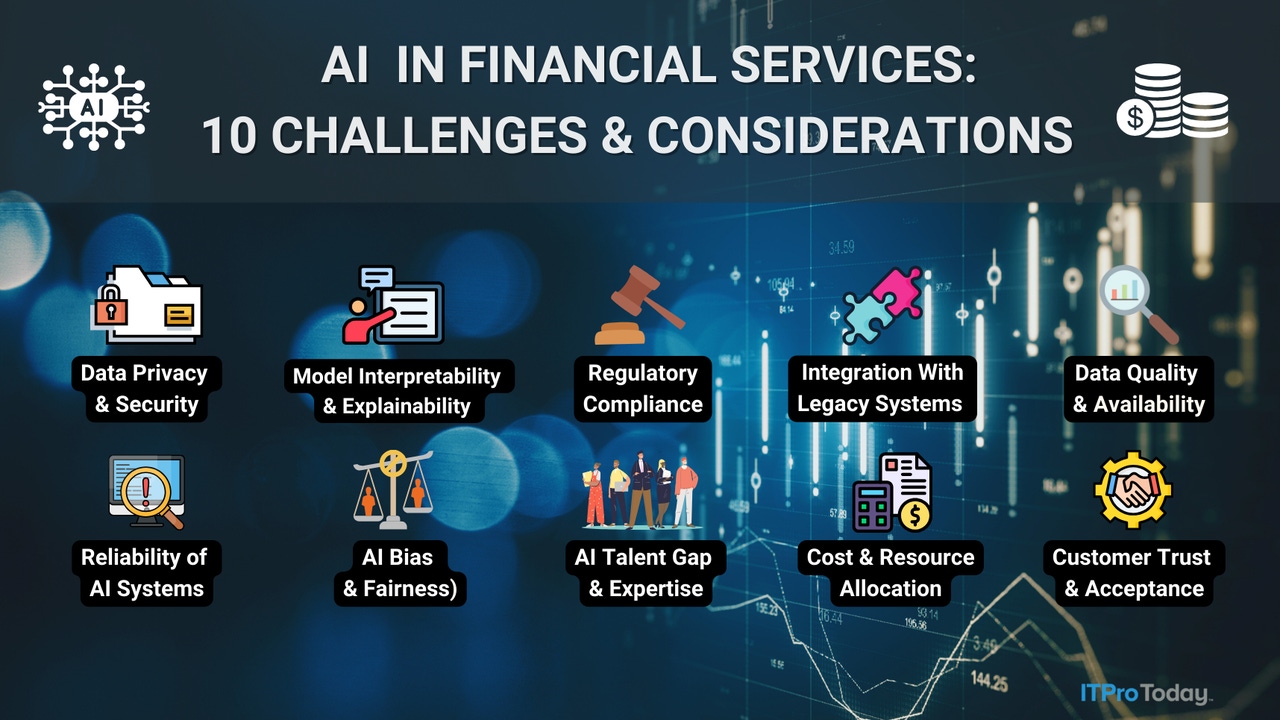

Challenges of AI in Financial Services

The many successes of AI in financial services often overshadow the challenges.

“It’s difficult for many companies to adopt AI because applications require strict security and privacy practices,” AWS’ Marcus said.

Winston noted that AI systems require vast amounts of data, which raises concerns about data privacy and security. “Financial institutions must ensure compliance with regulations such as GDPR [General Data Protection Regulation] and CCPA [California Consumer Privacy Act] while safeguarding sensitive customer information,” he explained.

As part of a highly regulated industry, financial services companies must also contend with the interpretability and explainability of AI models. “Generative AI models can be complex and difficult to interpret, which may pose challenges in regulatory reporting and gaining the trust of stakeholders. Legislation is already in place in some geographies and is being proposed more formally in the U.S.,” Winston said.

AI algorithms can also inadvertently perpetuate biases in training data, leading to unfair outcomes in areas like lending and hiring. Winston added that ensuring fairness and transparency in AI models is a significant challenge. Additionally, AI models often deliver false alerts, which must be within tolerable limits to conform to regulatory requirements.

Another challenge is the talent gap. “Most financial institutions are actively seeking professionals with AI expertise to ensure safe and responsible implementation,” said Zac Maufe, global head of regulated industries at Google Cloud. Upskilling existing employees to fill new roles, such as AI quality assurance testers and AI product managers, is one way to address the problem.

What’s on the Horizon

Simply using general GenAI tools as a quick fix isn’t enough. “Financial services will need a solution built specifically for the industry and leverages deep data related to how the entire industry works,” said Kevin Green, COO of Hapax, a banking AI platform. “It’s easy for general GenAI tools to identify what changes are made to regulations, but if it does not understand how those changes impact an institution, it’s simply just an alert.”

According to Green, the next wave of GenAI technologies should go beyond mere alerts; they must explain how regulatory changes affect institutions and outline actionable steps.

As AI technology evolves, several emerging technologies could significantly transform the financial services industry. Ludwig pointed out that quantum computers, which can solve complex problems much faster than traditional computers, might revolutionize risk management, portfolio optimization, and fraud detection. Financial institutions like JPMorgan Chase and Barclays are already exploring quantum computing applications.

Additionally, blockchain technology offers a secure, decentralized, and transparent method for recording and verifying financial transactions, Ludwig said. Blockchain could streamline processes, reduce costs, and increase transparency in trade finance, cross-border payments, and asset management.

As for AI, “the initial implementation of AI in banks has been focused on transactional activities from fraud detection to customer service,” Green noted. “The next wave, powered by GenAI, will focus more on knowledge-sharing and efficiency across the entire institution.”

About the Author

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)